Diving into crypto can feel overwhelming — especially when you open a trading app and see charts full of candles, lines, and numbers that look like a stock market alien language. But don’t worry — learning how to read crypto charts is easier than you think and one of the most important skills for becoming a smart trader or investor.

What Is a Crypto Chart?

A crypto chart is a visual representation of a cryptocurrency’s price over time. It shows how the price moves, helping you spot trends, patterns, and trading opportunities.

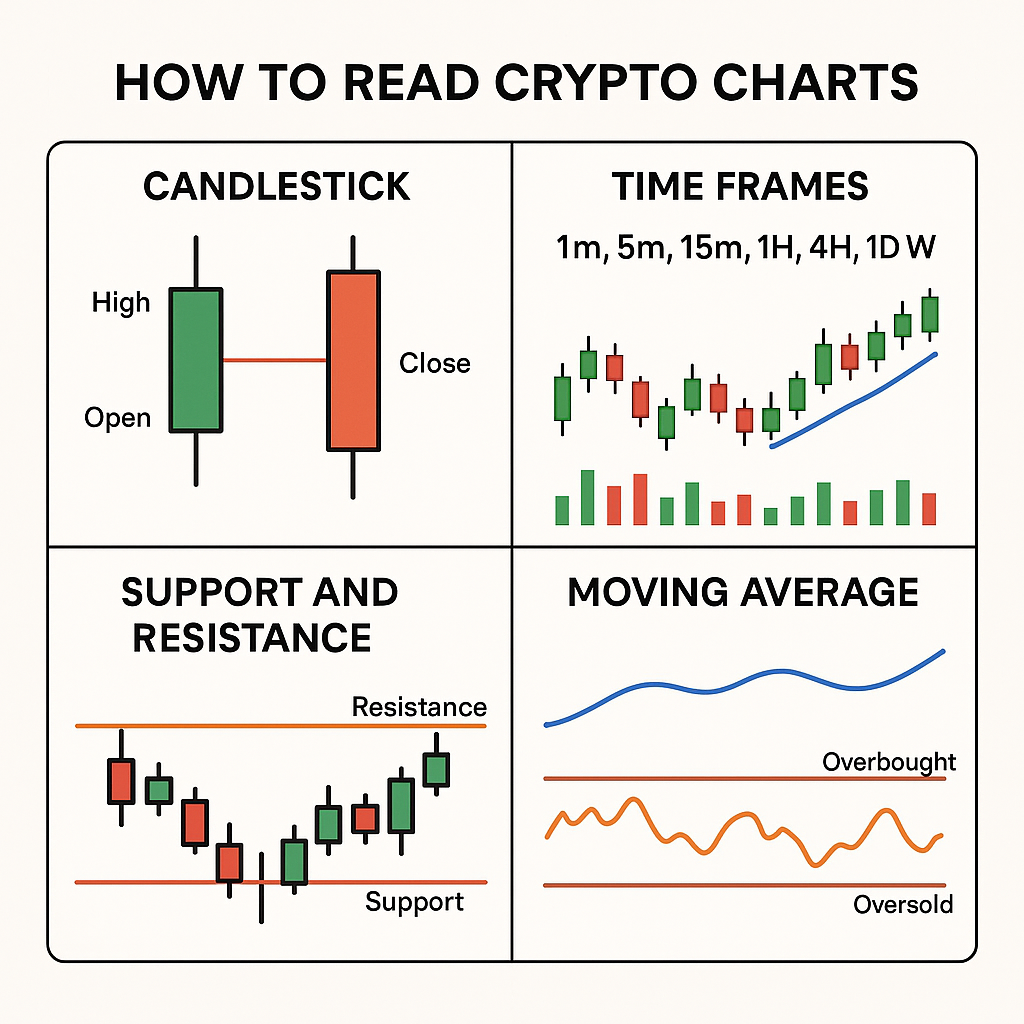

The most common type of chart used by traders is the candlestick chart — let’s start there.

Understanding Candlesticks (aka Candle Charts)

Each “candle” shows four key things about price movement over a set time (like 1 hour, 1 day, etc.):

- Open: The price at the start of the time period

- Close: The price at the end of the time period

- High: The highest price reached

- Low: The lowest price reached

🔴 Red Candle = Price went down

🟢 Green Candle = Price went up

Here’s a simple breakdown:

High

|

| Wick (line)

|

┌──┐ <– Open (for red)

│ │

│ │ <– Body (price range between open & close)

└──┘ <– Close (for red)

|

|

Low

In a green candle, the Open is at the bottom and the Close is at the top.

In a red candle, the Open is at the top and the Close is at the bottom.

Time Frames: What Do the Intervals Mean?

Crypto charts can be set to different time frames:

- 1m, 5m, 15m – Great for short-term scalping or day trading

- 1H, 4H – Good for swing trading

- 1D, 1W – Best for long-term investing and identifying trends

Tip: Always look at multiple time frames before making decisions. A coin can be pumping on the 5-minute chart but crashing on the 1-day!

Key Chart Elements to Know

1. Support and Resistance

- Support = Price level where buyers tend to step in (price bounces up)

- Resistance = Price level where sellers take profits (price pulls back)

These are horizontal lines you draw across recent highs and lows.

2. Trend Lines

A line connecting a series of higher lows (for an uptrend) or lower highs (for a downtrend). Helps spot the direction of the market.

3. Volume Bars

Usually at the bottom of the chart. High volume = strong interest. Low volume = weak moves.

Popular Technical Indicators for Beginners

You don’t need to use dozens of indicators — just start simple:

✅ 1. Moving Averages (MA)

- Smooths out price to show the average over a period (e.g. 50-day or 200-day MA).

- Helps identify trend direction and possible reversals.

✅ 2. Relative Strength Index (RSI)

- Measures if a coin is overbought (>70) or oversold (<30).

- Can help you find good entry or exit points.

✅ 3. MACD (Moving Average Convergence Divergence)

- A bit more advanced, but great for spotting trend changes and momentum.

Quick Chart Reading Tips

- Zoom out: Don’t get trapped in the noise of short time frames. Always understand the bigger picture.

- Watch for patterns: Basic ones include triangles, flags, head & shoulders — they often repeat.

- Combine tools: One indicator alone is not enough. Use candlestick patterns + support/resistance + RSI for stronger signals.

⚠️ Don’t Rely Only on Charts

Charts are helpful, but not foolproof. Combine chart reading with:

- News and fundamental analysis

- On-chain data (like wallet activity)

- Your own risk tolerance and goals

And always remember — no one can predict the market 100%. Use charts to guide decisions, not guarantee profits.

Ready to level up? In the next post, we’ll dive into popular chart patterns and what they mean (like cup & handle, double bottom, and bull flags).

📬 Subscribe Telegram channel for updates, and happy charting!